Everyone has dreams but only a few make them a reality. The reason behind the success is preparation and focus. Many people save money for future requirements like buying a dream home, seeing their child graduate from a premier school, traveling the world or enjoying their retirement. Such #LifeGoals give meaning to our life but is saving money the right way to prepare for these?

The answer is “No”. Savings are generally not focused on a specific purpose or achieving #LifeGoal. When sudden requirement arises, we tend to use our savings for that requirement delaying or even canceling our future goals. Low returns is another reason why saving is not the best strategy when it comes to preparing for a specific #LifeGoal.

In my post, 3 Financial lessons I learnt at the Bajaj Alliance Life Insurance Bloggers Meet, I had mentioned the 3 Financial lessons that help me understand how I can financially plan for any goal and get the highest return out of it.

Bajaj Allianz Life Goal Assure is a policy that helped me plan and focuses my investment for a specific goal.

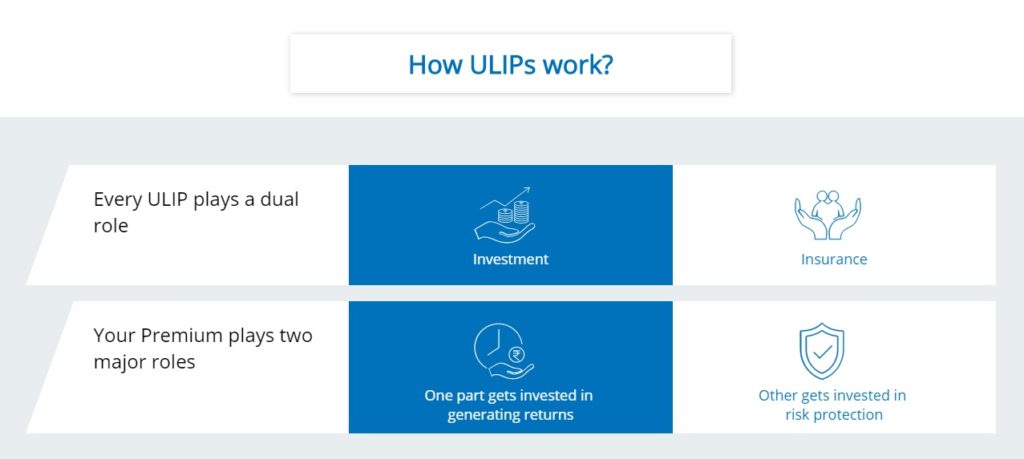

Bajaj Allianz Life Goal Assure is a new-age #ULIP for life maximizers. It is a life goal based ULIP plan that provides an opportunity to plan yours once in a lifetime experiences with zero worries. With the choice of eight funds investment strategies, the return of life cover charge on policy maturity, tax-free returns on your investment and life cover; it is the best investment your money can buy. Furthermore, you can opt to receive the maturity benefit in installments by staying invested in fund(s) of your choice and receive the benefit of Return Enhancer, which is an addition of 0.5% of each due installment.

7 Benefits of Investing in Bajaj Allianz Life Goal Assure

1. Return Of Life Cover Charges*:

At the end of the policy term, on the date of maturity, the total amount of mortality charge deducted throughout the policy term w.r.t regular premium and top-up premium, if any, will be added back, respectively, into the Regular Premium Fund Value and into the Top up Fund Value, as applicable. This helps you to get more value for your investments & realize your life goals.

2. Return Enhancer:

Which is an addition of 0.5% of each due installment. During this period, the customer’s fund value will continue to participate in the fund(s) of his/her choice.

3. Four Portfolio Strategies⁺:

You can choose from 4 portfolio strategies according to your investment style to accomplish your life goals, such as

Strategy 1: Investor selectable portfolio strategy:

Policyholder can allocate the premiums based on his/her personal choice among the 8 funds & to suit his/her investment needs.

Strategy 2: Wheel of life portfolio strategy:

At different Life stages, everyone has different financial goals and therefore the investment strategy needs to be realigned to the same. Once this portfolio is chosen, basis years to maturity the premium paid and the fund value will be allocated to various funds (namely Bluechip Equity Fund, Equity Growth Fund II, Accelerator Mid-Cap Fund II, Bond Fund & Liquid Fund) in the proportion depending on the outstanding years to maturity.

Strategy 3: Trigger based portfolio strategy:

This portfolio strategy is helpful in securing the gains and maintaining the asset allocation. One can opt for this strategy at the commencement of the policy only. Premiums will be allocated in two funds Equity Growth Fund II (an equity oriented fund) & Bond Fund (a debt oriented fund) at 75:25 ratio and the same will be re-balanced/re-allocated based on a pre-defined trigger event (15% upward movement in NAV (unit price) of Equity Growth Fund II) since the previous rebalancing or from the NAV (unit price) at the inception of the policy, whichever is later. On the occurrence of trigger event, the fund value in Equity Growth Fund II which is in excess of three times the fund in Bond Fund will be considered as gains and will be switched to Liquid Fund by redemption of units from Equity Growth Fund II.

Strategy 4: Auto transfer portfolio strategy:

This portfolio strategy helps the policyholder to invest his/her money in a systematic manner over the years by automatically transferring it every month, from a low risk fund to fund (s) of his/her choice. The proportion to be switched will depend upon the number of outstanding months till the next premium due date. The strategy will not be available if the policyholder has opted for monthly mode.

4. Unlimited Fund Switches:

Invest as per your choice among the 8 funds available under Investor Selectable Portfolio strategy and switch between them without any tax liability.

5. Life Cover To Protect Your Family:

In case of death of the policyholder, if all due premiums are paid, the nominee receives the Higher of (Sum assured~ or Regular Premium Fund Value), plus Higher of (Top up Sum Assured or Top up Premium Fund Value. The above benefits will be payable as on date of intimation of death. This benefit is subject to a minimum guaranteed benefit of 105% of total premiums* paid.

6. Tax Benefits#:

This plan offers tax benefits at the time of investment as well as on maturity. Tax Benefit on investment up-to INR 150,000 can be claimed as a deduction under section 80C (life insurance). Under Section 10(10D), for ULIP’s, where the premium payable to the sum assured does not exceed 10%, the amount received on partial withdrawal or maturity is exempt from tax.

7. Get More Value For Staying Invested^:

Get Loyalty Additions & Fund Boosters for paying premium regularly and staying invested. So now why worry and limit our self to small returns.

(1minimum switching amount is Rs. 5,000 or the value of units held by the policyholder in the fund to be switched from, whichever is lower.

^ subject to policy terms & conditions

# Subject to provisions as per Income Tax Act, 1961. Tax Laws are subject to change.

* if all premiums under the policy are paid up to date, the above will exclude any extra mortality charge and/or any GST w.r.t. mortality charge deducted. No ROMC will be available in a surrendered policy, a discontinued policy or a policy converted to paid-up.

Thank you for the wonderful links and resources.

Just checked your list of Blog Commenting Sites and find it amazing. I’ll surely come back to you for more tips and sites that help me out. Thanks.

Sabbir recently posted…CNG Track

Got to know a lot from this!

Everything was so relatable.

Thank you for sharing

Thank you so much for your work. It’s very helpful to me. I am waiting for your next article.

Thanks for sharing this. Loved how you have curated the flow of the blog.

Indicash ATM recently posted…Hyundai

Thank you so much for your work.It’s very helping to me.give me some advice.I will wait for your reply

I am getting -2% negative return in this Baja Allianz Goal assure plan.

80% is invested on BOND fund.How it can goes in a such negative???

what are doing fund manager???? they are charging fund allocation/admin charges…so whay -ve retun???

I am really frustrated with this ULIP plan. Never ever suggest any one foe that

in which fund performance should i choose in bajaj allianz goal assure plan

Dear Sir,

My policy no. is 034970857.

please send me link for online payment of my monthly SIP